It is absolutely true that if a country has a lot of debt, it must pay it sooner or later. Searching for the future picture, an excess of public debt can be analyzed in terms of a vicious circle of more taxes, less consumption, less production, less public incomes and more taxes again. This scheme can seem useful for the simple minds, but all of us know that economy is much more complex than this.

Why economy is so complex? The reason is that there are a lot of factors involved, these factors cannot be easily measured as mathematical variables, if we measure some of them, there are a lot of links among the variables that we have chosen, there is not a perfect mathematical model of these relationships, and there is a lot of uncertainty about the way that rulers will make decisions in the future and the consequences that will produce these decisions.

But, please, let us go back to the vicious circle. Looking at it, we can find that there is only a way to find an exit. Governments only can act on one of the phases. Consumption, production and then public incomes are a decision taken by the citizens. Rulers only can act on taxes, following that scheme; the only way to abandon the vicious circle is reducing taxes, and then, if there is a debt problem, reducing public expenses in order to be able to do it is the best way. A country that reduces public expenses and taxes always should be considered a good investment.

It seems easy, does not it? Theoretically yes, but it is not as easy implementing it in practice, because the apparatus of the state has a lot of inertia especially where it is heavy. Private economy is always much more adaptable. On the other hand in many occasions the economy can be in a certain working point where this assumption of reducing expenses cannot provide the expected effect. Following this scheme, it results very strange that many experts consider a good piece of advice increase consumption taxes to reduce debt. This would be a good action only in a country where labor was better paid than other production factors and not, for instance, in country with a high unemployment. When results come, I suppose that, as usual, the same advisors turned into analysts will say that the government of the country had not taken the proper decision with its policies.

The main reason to discard classic economy models is based on technology. Most of economy models have not considered the variable technology because is not easily measured and managed. We can include the technology level as a variable in an economy model, but how can we obtain a useful and controllable measure?

I will try to illustrate this with an example. For instance I can propose an initial indicator to measure some aspect of the technology level useful for the economy of a country: The Business Enterprise Researchers per capita. And I am going to compare the four more decisive Euro economies.

Graph 1 Business Enterprise Researchers per capita of the main Euro economies. Data Source OECD

There is a visual perception of the difference between the productive technology level of Northern and Southern countries. Including public researchers the situation can be different but now I am interested in the short-term and mid-term evolution of the economy and the private researchers can be a better indicator for analyzing the evolution of productive sector in those cases.

This graph is showing only an aspect of the technology level, it is related to innovation production, but technology level can be provided through technology transfer.

OECD has not provided the full set of piece of data about France and we must forget it for the next analysis.

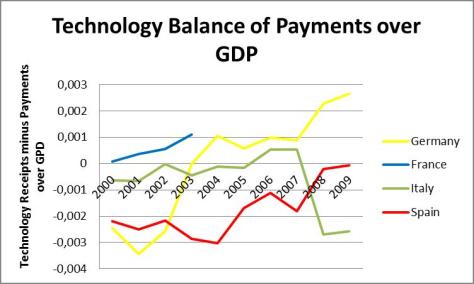

Graph 2 Technology Balance of Payments of three Euro countries in 2009. Data Source OECD

We can see that Germany is a net producer country of technology, Italy is acquiring more technology that produces and Spain is practically producing the same technology that is acquiring outside. But we can go further in order to analyze the reasons of that position of Italy.

Graph 3 Analysis of the Technology Transfer through the Technology Balance of Payments. Data Source OECD

Technology balance of payments is not a good variable to analyze the technology level because a negative balance is showing simultaneously that a country needs technology (lower technology level) and it is acquiring it (it has increased its technology level). Anyway, we can find some interesting issues here:

– Germany has been a net consumer of technology before 2003, and now it is a net producer of technology.

– The world economy crisis of 2007 due to the subprime mortgages in the USA produced an inflection point in the European technology market. Germany and Spain improve the balance but Italy gets worse.

To complete this analysis we should probe if the zero balance of Spain is due to an increase of the production. As we can see in the following graph:

Graph 4 Causes of the evolution of the Spanish technology balance of payments. Data Source OECD

As we can see the receipts were increased in relative terms while the payments remain in a similar value. This is showing a good behavior of the technology production Spanish sector during the first years after the subprime crisis.

As conclusion I propose to think about a few issues:

– Usual economic models do not consider well the importance of technology.

– It is questionable to accept that the risk bonus of the public debt is related to the real growth potential of an economy.

– Spanish economy seems to have been driven by wrong financial decisions on public expenditure and banking instead of ruling decisions for promoting its best competences on productive activity acquired during the last years.

|

Mr. Luis Díaz Saco Executive President saconsulting advanced consultancy services

|

Nowadays, he is Executive President of Saconsulting Advanced Consultancy Services. He has been Head of Corporate Technology Innovation at Soluziona Quality and Environment and R & D & I Project Auditor of AENOR. He has acted as Innovation Advisor of Endesa Red representing that company in Workgroups of the Smartgrids Technology Platform at Brussels |

[…] via October 2012: Must the future of a country be qualified only by its public debt? « Guru’s Ana…. […]